reverse tax calculator ny

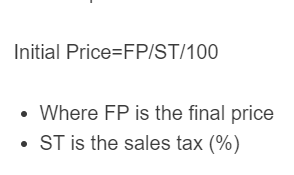

How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100. Opry Mills Breakfast Restaurants.

To Save Enough To Reach 1 Million You Can Put Aside Far Less Than 1 Million Here S Why Http Money Us Wkb9tt Smart Money Better Money Habits Money Habits

Enter the security code displayed below and then select Continue.

. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state. Divide the price of the item post-tax by the decimal value. Subtract the price of.

New York Unemployment Insurance. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Certain churches and non-profits are exempt from this payment.

See the article. If you are married and filing a joint New York State income tax return both spouses should establish their. Learn more about your NY UI rate here.

Current HST GST and PST rates table of 2022. Download this app from Microsoft Store for Windows 10 Windows 81 Windows 10 Mobile Windows Phone 81. In parts of the state like New York City all types of taxes are even higher.

Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Reverse Sales Tax Calculator of New York for 2020 Q1.

The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax. New York Income Tax Calculator. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax.

The NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more. Tax rate for all canadian remain the same as in 2017. You obviously may change the default values if you desire.

Income Tax Rate Indonesia. How to estimate the tax. Enter the sales tax percentage.

View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4-or-more family homes here. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax New York QuickFacts.

How much Mortgage Recording Tax you pay is based on the size of your loan as opposed to the purchase price. Use this database to calculate the all-in property tax bill in a given locality or to compare property tax burdens among multiple localities. Majestic Life Church Service Times.

The harmonized sales tax or hst. 805 cents per gallon of regular gasoline 800 cents per gallon of diesel. If youre a new employer youll pay a flat rate of 3125.

Overview of New York Taxes. New York State Tax Quick Facts. Soldier For Life Fort Campbell.

Enter the sales tax percentage. Restaurants In Matthews Nc That Deliver. Now you divide the items post-tax price by the decimal value youve just acquired.

Overview of New York Taxes. Reverse Tax Calculator Formula. See screenshots read the latest customer reviews and compare ratings for Reverse Tax Calculator.

Lets calculate this value. The NYC Mortgage Recording Tax does not apply to co-op apartments. On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825.

Reverse sales tax calculator ny Monday March 7 2022 Edit. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The MRT is the largest buyer closing cost in NYC.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. You should use one of the forms below to compute your estimated tax payments. You can pay electronically check balances and review payments in your estimated tax account by creating an Online Services account.

Penalty and Interest Calculator. The term Jumbo Reverse Mortgage is used to refer to a reverse mortgage that allows a borrower to borrow more than the maximum amount allowable under the HECM program. The Property Tax database calculates the combined property tax rate and total average property tax bill including schools and local governments in every New York locality.

Enter the final price or amount. The calculator will show you the total sales tax amount as well as the county city and special. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax.

Reverse Tax Calculator 2022-2023 This valuable tool has been updated for with latest figures and rules for working out taxes. New York is generally known for high taxes. The following security code is necessary to prevent unauthorized use of this web site.

Are Dental Implants Tax Deductible In Ireland. Enter the total amount that you wish to have calculated in order to determine tax on the sale. It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income.

2675 107 25. 3078 - 3876 in addition to state tax Sales tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts.

This will give you the items pre-tax cost. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax. In New York such a reverse mortgage is called a proprietary reverse mortgage and is made pursuant to New York Real Property Law Section 280 or 280-a.

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

New York Sales Tax Calculator Reverse Sales Dremployee

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator Calculator Academy

Forex Trade Signals Reverse Mortgage Mortgage Mortgage Loans

Reverse Stock Split Excel Calculator And General Electric Ge Example

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedishowweroll Academymortgage Va Loan Conventional Loan Refinance Mortgage

Home Mortgage Loan Stock Illustration Illustration Of Equity 26958976 Home Mortgage Reverse Mortgage Mortgage Loans

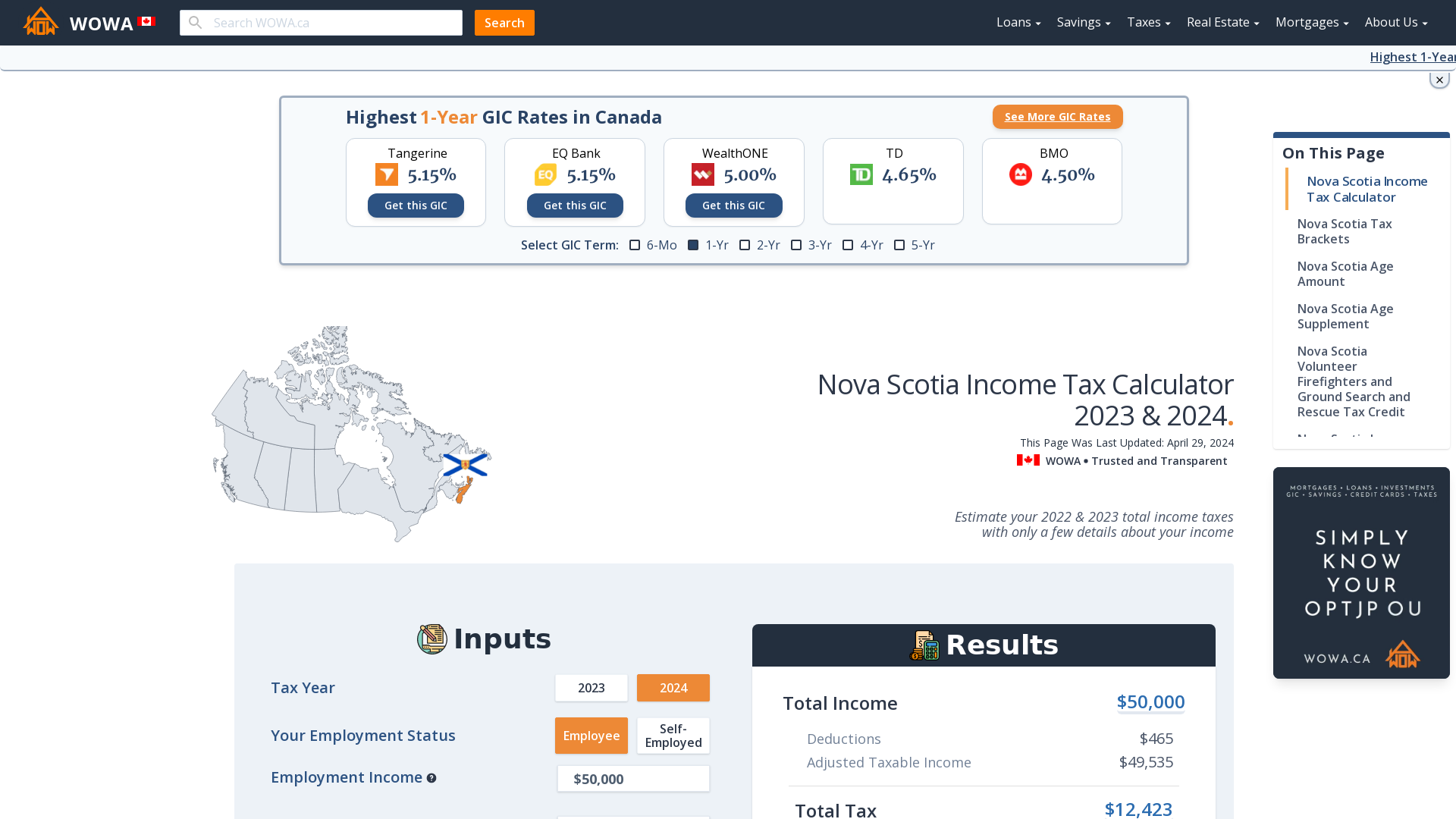

Nova Scotia Income Tax Calculator Wowa Ca

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator 100 Free Calculators Io

The 4 Best Cost Of Living Calculators Ciresi Morek

Best Wireless Merchant Service Account Providers Merchant Account Merchant Services Accounting